Tips For Filing Baltimore Personal Injury Insurance Claims

Filing an insurance claim can often feel like a daunting process. The paperwork, the wait, and the potential disputes can leave you feeling overwhelmed. That’s why we’ve compiled these Tips For Filing Baltimore Personal Injury Insurance Claims to help you navigate through the process of filing an insurance claim. It’s not exhaustive, but will provide guidance for those battling an insurance company for meaningful compensation. I’ve also included a few things to avoid in your quest for a fair monetary award.

#1 Tip For Filing Baltimore Personal Injury Insurance Claims: Review your Insurance Policy

The first step is to understand your policy. Take the time to thoroughly review your insurance policy to know exactly what is covered and what isn’t. Pay special attention to any exclusions or limitations. If there are any areas that you don’t understand, don’t hesitate to reach out to your insurance provider for clarification. Knowledge is power, and the more you understand your policy, the better equipped you’ll be to file a successful claim.

Baltimore Personal Injury Insurance Claims Tip #2. Timeliness is Key.

Once you have a good understanding of your policy, it’s important to report the incident promptly. In the event of an accident or loss, report it to your insurance provider as soon as possible. The quicker you report the incident, the sooner the claim process can begin. Be sure to gather all the necessary information and documentation before you make the call. This includes the date and time of the incident, the location, any people involved, and any other relevant details. Timeliness is crucial, and a prompt report can make a significant difference in the outcome of your claim.

#3 Tip: Documentation is Vital in Baltimore Personal Injury Insurance Claims

When it comes to documenting the incident, be as detailed as possible. Take photographs, keep receipts, and collect any other evidence that can support your claim. This will help your insurance provider assess the situation and determine the appropriate compensation. The more evidence you have, the stronger your claim will be. So, don’t overlook this crucial step in the process. If your injuries are evolving, under evaluation, or, getting worse, be sure to fully explain the status to the insurance claims adjuster.

Another tip is to be honest and accurate in your report. Providing false or misleading information can result in a denied claim or even legal action. Be sure to double-check all the information you provide to ensure its accuracy. Honesty is always the best policy, and transparency can go a long way in building a strong case.

Once your claim has been filed, it’s important to keep track of the progress. Stay in regular communication with your insurance provider and ask for updates on the status of your claim. If there are any additional documents or information needed, be sure to provide them in a timely manner. Being proactive and staying on top of your claim will help expedite the process and increase your chances of a favorable outcome.

In some cases, disputes may arise during the claim process. Sometimes, the Maryland Insurance Administration can assist. This could be due to a disagreement over the compensation amount, the coverage, or any other aspect of the claim. If this happens, consider seeking legal assistance. A skilled Baltimore, MD insurance claim lawyer can help you navigate through the complexities of the insurance claim process and ensure that you receive the compensation you deserve.

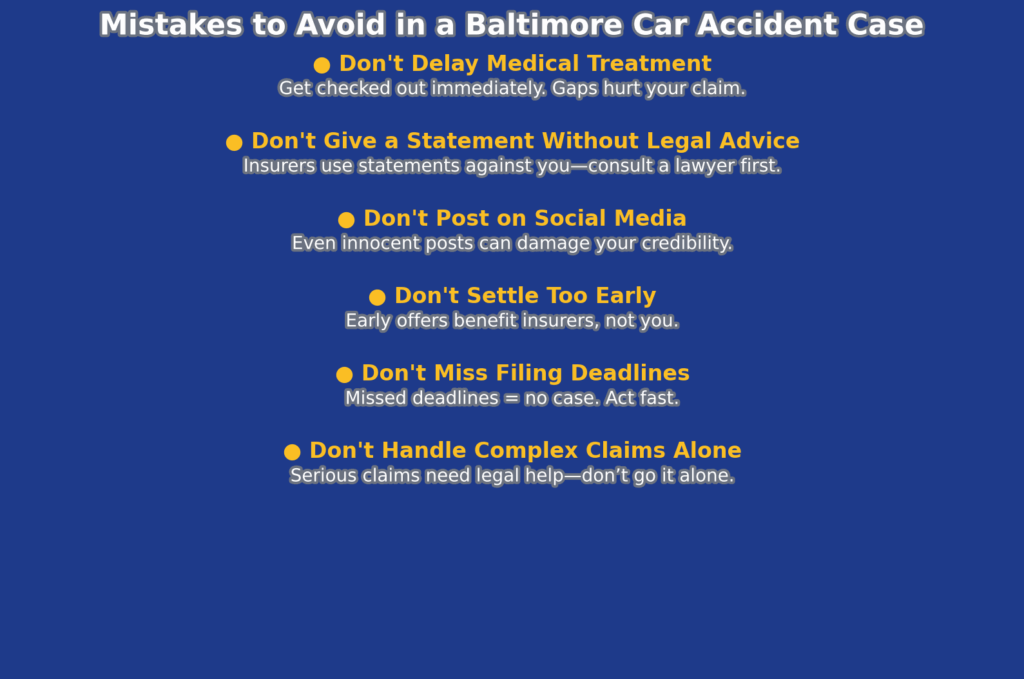

Step-by-Step: Mistakes to Avoid When Filing a Baltimore Car Accident Case

Filing a car accident claim in Baltimore can be a complex and stressful experience. Actually getting compensated can quickly take those emotions to the next level. Avoiding common missteps can make a significant difference in your ability to recover full compensation. Here are key mistakes to avoid, and how to stay on track at each stage of your personal injury claim.

-

Don’t Delay Medical Treatment

Delaying medical care is one of the most common—and damaging—mistakes. Even if you don’t feel severely injured at the scene, adrenaline can mask symptoms. If you think you are injured, get checked out as soon as possible. If you are not hurt, that’s great! You don’t have to worry amount messing up a personal injury case. If you have been hurt, gaps in treatment can be used by the insurance company to argue your injuries aren’t serious or related to the accident.

-

Don’t Give a Statement to the Insurance Company Without Legal Advice

Insurance adjusters often contact injured parties shortly after a crash. They may ask for a recorded statement. This may seem harmless, but their goal is to limit your claim. Always speak with a personal injury lawyer before giving any official statement.

-

Don’t Post About the Accident on Social Media

What you say online can and will be used against you. Insurance companies often scour social media for evidence. Even innocent posts can be taken out of context. Avoid sharing details about the accident, your injuries, or your daily activities while your case is pending.

-

Don’t Settle Too Early

Quick settlements often benefit insurers—not injured individuals. You may not yet know the full extent of your injuries or future medical needs. Once you accept an offer and sign a release, you can’t go back and ask for more, except in limited circumstances. Be patient, and don’t sign anything until your condition is stabilized and properly evaluated.

-

Don’t Miss the Deadline to File

Maryland law gives most accident victims three years to file a personal injury lawsuit, but certain exceptions can shorten this window. If you wait too long, your claim can be permanently barred. Consulting a lawyer early ensures deadlines are preserved and evidence is preserved.

-

Don’t Handle Complex Claims Alone

Cases involving serious injuries, disputed liability, or uninsured drivers require experienced legal representation. Trying to handle these on your own can lead to missed compensation or costly mistakes. An experienced Baltimore car accident lawyer can help you build the strongest case possible and handle negotiations with the insurance company. The biggest benefit is the abililty to take the case to court and trial if those negotiations fail.

Remember, the goal of filing an insurance claim is to get the compensation you are entitled to. By following these tips and seeking professional assistance when needed, you can make the process as smooth and stress-free as possible. Keep in mind that patience is key, and while the process may be lengthy, the end result will be worth it.

Attorney Eric T. Kirk is here to support you through the insurance claim process. Our team of experienced professionals is committed to helping you understand your policy, file your claim, and receive the compensation you deserve. Let us be your advocate and guide you through each step of the way. Together, we will navigate the complexities of the insurance claim process and secure the outcome you are seeking. Reach out to us today, and let us put our expertise to work for you.